1099 Job Opportunities: Comprehensive Freelancer Insights for 2024

The 1099 job market has exploded over the past five years, transforming how millions of professionals work and earn income. Whether you’re considering your first freelance position or expanding your portfolio of independent contracts, understanding 1099 opportunities is essential for building a sustainable career. A 1099 job refers to independent contractor work, named after the IRS tax form that freelancers file instead of traditional W-2 employment.

The appeal of 1099 work extends far beyond flexibility. Many professionals discover that independent contracting offers higher hourly rates, diverse project opportunities, and the autonomy to shape their own career trajectory. However, this freedom comes with responsibilities that traditional employees never face—from managing taxes to securing your own benefits. This comprehensive guide explores the landscape of 1099 job opportunities, revealing insider insights that can help you navigate this dynamic work environment successfully.

Understanding 1099 Jobs and Independent Contracting

A 1099 job fundamentally differs from W-2 employment in critical ways that impact your income, benefits, and tax obligations. When you accept a 1099 position, you’re operating as an independent contractor rather than an employee. This distinction matters tremendously because it determines what taxes you owe, what benefits you receive, and what legal protections apply to your work relationship.

Independent contractors typically enjoy greater control over how, when, and where they work. You might choose your own hours, select which projects interest you, and set your own rates—though clients often have final say on compensation. Unlike employees who receive benefits like health insurance, retirement contributions, and paid time off, 1099 contractors must secure these independently. This flexibility appeals to professionals seeking autonomy, but it requires entrepreneurial thinking and careful financial planning.

The IRS uses specific criteria to determine contractor status. Generally, if you control the means and methods of your work, work with multiple clients, provide your own equipment, and maintain financial risk in the relationship, you’re likely a legitimate contractor. However, misclassification remains a common problem, with some employers incorrectly labeling employees as contractors to avoid payroll taxes and benefits obligations.

Understanding your status protects you legally and financially. If you suspect misclassification, consulting with a tax professional or employment attorney can clarify your situation. The IRS Independent Contractor Tax Center provides detailed guidance on contractor classifications and obligations.

Top Industries Offering 1099 Opportunities

Technology continues to dominate the 1099 landscape, with software development, UX design, and data analysis commanding premium rates. Tech companies ranging from startups to Fortune 500 firms regularly hire independent contractors for specialized projects, temporary skill gaps, and seasonal demands. Software developers, mobile app creators, and cloud infrastructure specialists find abundant opportunities in this sector.

Creative fields—including writing, graphic design, video production, and photography—have traditionally embraced freelance models. Content creators, illustrators, and multimedia specialists often work entirely on 1099 contracts, building portfolios across multiple clients. The rise of digital marketing has expanded opportunities further, with social media managers, SEO specialists, and content strategists in high demand.

Consulting and business services represent another robust sector for 1099 work. Management consultants, HR specialists, business analysts, and financial advisors frequently operate as independent contractors. These roles often attract seasoned professionals leveraging decades of experience across multiple client engagements simultaneously.

Healthcare and professional services sectors increasingly hire 1099 contractors, particularly in nursing, physical therapy, mental health counseling, and medical writing. The healthcare industry’s complexity and regulatory requirements actually increase demand for specialized contractors who can address specific needs without long-term employment commitments.

Administrative and customer service roles, while traditionally employment-based, now frequently appear as 1099 opportunities. Virtual assistants, bookkeepers, customer service representatives, and project coordinators find numerous contract positions through specialized platforms and agencies.

Teaching and tutoring represent underutilized 1099 opportunities. Online education platforms, corporate training providers, and individual clients seeking specialized instruction create consistent demand for educators across numerous subjects and skill levels. Language instruction, test preparation, and professional development training all offer viable contractor positions.

Finding and Landing 1099 Contracts

The proliferation of freelance platforms has democratized access to 1099 opportunities. Upwork, Fiverr, Toptal, and Guru connect millions of contractors with clients worldwide. These platforms handle payment processing, dispute resolution, and client vetting—reducing administrative burden though typically taking 5-20% commissions. Success on these platforms requires compelling profiles, strong portfolio pieces, and consistent positive reviews.

Industry-specific job boards often yield higher-quality contracts than general platforms. Designers find opportunities on Dribbble and Design Jobs Board, writers use Mediavine and ProBlogger, and developers explore Stack Overflow Jobs and GitHub. These specialized platforms attract serious clients willing to pay premium rates for proven expertise.

Networking remains the most effective—though underutilized—method for landing 1099 work. Building genuine relationships with past colleagues, attending industry conferences, and engaging authentically on LinkedIn creates referral pipelines that generate consistent, well-compensated work. Many contractors report that 50-70% of their best contracts come through personal networks rather than job boards.

Staffing agencies and recruiting firms increasingly place contractors into 1099 positions. These agencies handle candidate screening, contract negotiation, and client relationships, allowing you to focus on delivery. While agencies take commissions, they often secure higher rates and more stable work than independent job hunting provides.

Direct outreach to potential clients through personalized emails, LinkedIn messages, and portfolio demonstrations can yield surprising results. Identifying companies and decision-makers in your target market, then demonstrating how your skills solve specific problems, creates opportunities that never appear on job boards. This approach requires research and persistence but often results in higher-value contracts.

Building your own website and thought leadership presence attracts inbound opportunities. Publishing articles, sharing insights on social media, and demonstrating expertise through content marketing positions you as an authority that clients actively seek. This long-term strategy pays dividends as your reputation compounds over time.

Consider exploring job fair opportunities and networking events, even as a contractor. These venues often feature companies seeking specialized contract talent and provide face-to-face relationship-building advantages that digital platforms cannot match.

Rate Setting and Negotiation Strategies

Determining appropriate 1099 rates represents one of the most challenging aspects of freelance work. Unlike W-2 employees receiving consistent paychecks, contractors must account for irregular income, self-employment taxes, benefits, and business expenses when calculating rates. The formula: (desired annual salary ÷ billable hours) + (overhead costs) + (profit margin) provides a starting framework.

Most contractors should charge 1.5-2x their equivalent W-2 salary to account for benefits they must purchase independently, taxes they cover entirely, and periods without billable work. A developer earning $100,000 as an employee might charge $60-75/hour as a contractor (working roughly 1,500 billable hours annually), which translates to $90,000-112,500 annually before taxes and business expenses.

Market research through platforms like Glassdoor, PayScale, and industry-specific salary surveys informs competitive rate-setting. Freelance platforms publish average rates by skill and experience level, providing benchmarks. However, rates vary significantly by geography, client budget, and project complexity—so research your specific niche thoroughly.

Experience and specialization command premium rates. Generalist contractors might charge $25-50/hour, while specialized experts with demonstrated results earn $100-300+/hour. Building deep expertise in high-demand niches dramatically increases earning potential and client quality.

Negotiating rates requires confidence balanced with pragmatism. Research market rates, understand your value proposition, and present rates as professional recommendations rather than arbitrary numbers. Many contractors find that explaining rate calculations—what covers taxes, benefits, equipment, and business operations—helps clients understand pricing. When clients resist rates, exploring scope reduction or phased engagement often proves more successful than simply lowering prices.

For insights on negotiation tactics, explore our comprehensive guide on how to negotiate salary, which applies directly to contractor rate discussions. Additionally, understanding commission-based compensation models helps contractors structure creative payment arrangements aligned with client success metrics.

Payment terms matter as much as rates. Negotiate upfront deposits (typically 25-50% for new clients), milestone-based payments for ongoing projects, and clear invoice terms (net 15 or net 30). Protecting cash flow prevents financial stress and demonstrates professional business practices.

Managing Taxes and Business Expenses

Self-employment taxes represent the biggest financial surprise for new 1099 contractors. Unlike W-2 employees who split Social Security and Medicare taxes with employers, contractors pay both portions—approximately 15.3% of net income. This obligation exists regardless of whether clients withhold taxes, making quarterly estimated tax payments essential for avoiding penalties.

Tracking business expenses meticulously reduces taxable income significantly. Legitimate deductions include equipment, software subscriptions, office space (including home office depreciation), professional development, marketing expenses, and client-related travel. Maintaining detailed records with receipts and invoices protects you during audits and ensures you capture every eligible deduction.

Home office deductions provide substantial tax savings for contractors working from home. Using either the simplified method ($5 per square foot, maximum 300 square feet) or actual expense method, you can deduct portions of rent/mortgage, utilities, insurance, and maintenance proportional to your office space. Many contractors overlook this deduction entirely, leaving money on the table.

Retirement savings options for self-employed individuals offer tax advantages while building long-term security. SEP-IRAs allow contributions up to 25% of net income (maximum $66,000 in 2024), while Solo 401(k)s provide higher contribution limits and loan options. Contributing to retirement accounts reduces current taxable income while building wealth—a crucial benefit since contractors lack employer retirement plans.

Working with a tax professional familiar with contractor taxation prevents costly mistakes and maximizes deductions. Tax accountants specializing in freelance work understand nuances that general preparers miss, often saving far more than their fees. The investment in professional guidance pays dividends through properly structured businesses and optimized tax strategies.

Quarterly tax planning prevents year-end surprises and cash flow crises. Setting aside 25-30% of gross income into a dedicated tax account ensures you can pay quarterly estimated taxes without stress. This disciplined approach converts taxes from a burden into a manageable business expense.

Building Long-Term Stability as a Freelancer

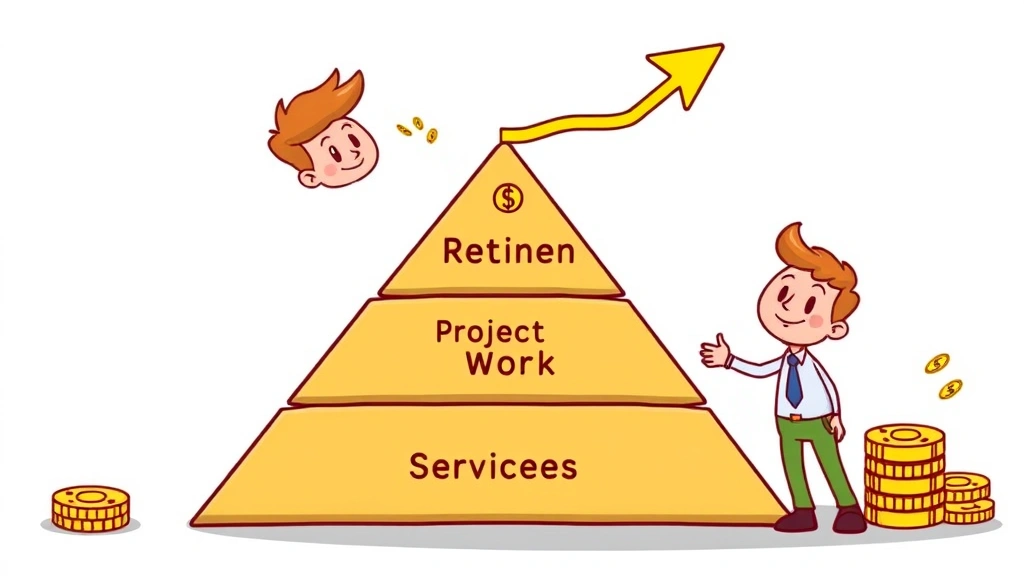

Income volatility characterizes 1099 work, particularly in early years. Building stability requires deliberate strategies that create predictable revenue streams. Long-term retainer clients—paying monthly fees for ongoing services—provide income foundation that reduces stress and enables planning. Retainers typically pay 20-30% less than project rates but offer consistency that justifies the discount.

Diversifying client bases protects against catastrophic income loss when individual clients end engagements. Contractors dependent on single clients face devastating disruption when that relationship ends. Ideally, no single client should represent more than 20-30% of monthly income, creating resilience against unexpected terminations.

Building productized services—standardized offerings with fixed pricing and scope—creates scalability and efficiency. Instead of custom proposals for each inquiry, contractors offer defined packages (e.g., ‘Website Audit Package: $2,500’) that streamline sales, delivery, and client expectations. This approach often increases profitability while improving customer satisfaction.

Establishing emergency reserves provides crucial safety nets that W-2 employees often take for granted. Most financial advisors recommend contractors maintain 6-12 months of operating expenses in accessible savings, accounting for income irregularity and unexpected business disruptions. Building this reserve gradually through disciplined savings prevents financial crises during slow periods.

Investing in professional development maintains competitive advantage and supports rate increases. Learning emerging technologies, earning relevant certifications, and developing new skills justify premium pricing and expand market opportunities. Many contractors allocate 5-10% of income to continuous learning, viewing it as essential business investment.

Building a personal brand and thought leadership presence creates inbound opportunities that reduce reliance on active job hunting. Publishing articles, speaking at conferences, and sharing expertise positions you as an authority that clients actively seek. This passive marketing approach generates higher-quality leads and commands premium rates.

For additional perspectives on career stability and advancement, explore highest-paying career paths which include many viable 1099 opportunities requiring alternative credentials to traditional degrees.

Common Challenges and Solutions

Scope creep—clients requesting additional work beyond original agreements—represents the most pervasive contractor challenge. Clients often fail to recognize where project boundaries lie, gradually expanding deliverables without additional compensation. Preventing scope creep requires detailed written agreements specifying exact deliverables, revision rounds, and additional work pricing. When clients request scope additions, presenting change order documents and adjusted fees maintains professionalism while protecting your time.

Late payment and non-payment create cash flow nightmares for many contractors. Implementing upfront deposits (25-50%) for new clients, milestone payments for ongoing work, and clear payment terms (net 15) protects revenue. Consider payment platforms like Stripe or PayPal that process payments immediately, and establish policies for late fees that incentivize timely payment without damaging relationships.

Isolation and lack of community affect many remote contractors, particularly those working solo. Joining professional associations, attending industry conferences, and participating in contractor communities combats isolation while building networks. Coworking spaces offer structured environments that replicate office dynamics for contractors preferring social work environments.

Benefits and healthcare access create anxiety for contractors without employer-sponsored plans. Shopping individual health insurance through healthcare.gov, professional associations (which often offer group rates), or healthcare-sharing ministries provides coverage options. Budgeting healthcare costs into rates ensures you afford adequate coverage without financial strain.

Inconsistent work availability affects many contractors, particularly those relying on project-based engagements. Building retainer clients, developing productized services, and maintaining robust pipelines of prospects reduces gaps between projects. Many successful contractors maintain 2-3 months of pipeline visibility, ensuring consistent work availability.

Burnout from constant business development and delivery responsibilities exhausts many contractors. Establishing boundaries—specific work hours, vacation periods, and client availability windows—prevents burnout. Many contractors find that limiting active client work to 80% of time, reserving 20% for business development and skill building, creates sustainable rhythms.

For managing the stress inherent in freelance work, our guide on dealing with job stress offers practical strategies applicable to contractor situations. Additionally, exploring bonus structures and incentive opportunities helps contractors structure compensation creatively with clients seeking performance-based arrangements.

FAQ

What exactly is a 1099 job?

A 1099 job refers to independent contractor work, named after the IRS Form 1099-NEC that contractors file for tax purposes. Unlike W-2 employees, 1099 contractors operate as independent businesses, controlling their work methods while managing their own taxes, benefits, and business expenses. Contractors typically work for multiple clients, set their own rates, and maintain greater autonomy than traditional employees.

How much should I charge for 1099 work?

Appropriate 1099 rates depend on your experience, specialization, market demand, and geographic location. Generally, charge 1.5-2x your equivalent W-2 salary to account for self-employment taxes (15.3%), benefits you must purchase independently, and periods without billable work. Research your specific niche through platforms like Glassdoor, PayScale, and freelance marketplaces. Most contractors charge $25-50/hour for general skills, $50-100/hour for intermediate experience, and $100-300+/hour for specialized expertise.

Do I need to pay estimated taxes as a 1099 contractor?

Yes, absolutely. The IRS requires 1099 contractors to pay quarterly estimated taxes based on projected annual income. Failing to pay estimated taxes results in penalties and interest charges. Most contractors should set aside 25-30% of gross income for taxes, then pay quarterly installments (April 15, June 15, September 15, and January 15). Working with a tax professional ensures you calculate and pay appropriate amounts.

What business expenses can I deduct as a contractor?

Legitimate business deductions include equipment and software, professional development and certifications, office space and utilities (including home office), marketing and client acquisition expenses, insurance, and business travel. Maintaining detailed records with receipts proves deductions during audits. Home office deductions using either the simplified method ($5/sq ft, max 300 sq ft) or actual expense method provide substantial tax savings for contractors working from home.

How do I find 1099 job opportunities?

Multiple channels yield 1099 opportunities: freelance platforms (Upwork, Fiverr, Toptal), industry-specific job boards (Dribbble for designers, ProBlogger for writers), staffing agencies specializing in contractor placement, personal networking and referrals, and direct outreach to potential clients. Many contractors find that personal networks and direct relationships generate their highest-quality, best-compensated work. Building a professional website and thought leadership presence attracts inbound opportunities over time.

Should I form an LLC or corporation for 1099 work?

Forming a legal business entity (LLC or S-Corp) provides liability protection, potential tax advantages, and professional credibility. However, it requires additional paperwork, accounting, and filing fees. Many contractors start as sole proprietors (simplest structure), then form formal entities as income grows and complexity increases. Consulting with a business attorney and accountant helps determine the optimal structure for your specific situation.

How can I manage income variability as a 1099 contractor?

Building stability requires diversifying clients (no single client exceeding 20-30% of income), establishing retainer relationships providing predictable monthly revenue, maintaining 6-12 months of operating expenses in emergency reserves, and developing productized services with standardized pricing. Creating multiple revenue streams—retainers, project work, and productized offerings—smooths income fluctuations while building long-term resilience.

What benefits should I secure as an independent contractor?

Contractors must independently secure health insurance (through healthcare.gov, professional associations, or healthcare-sharing ministries), retirement accounts (SEP-IRA or Solo 401k), disability insurance, liability insurance (if applicable), and life insurance. These benefits represent significant expenses that should factor into rate-setting. Many contractors allocate 20-30% of gross income to benefits and taxes, ensuring adequate coverage without financial strain.